Latest Posts Scrolling

Barbatelli&Partners Announces Acquisition of In3Act China

[Shanghai, January 15th] – Barbatelli & Partners, a leading Management Consulting company with more than 30 years’ experience serving European SMEs in China, proudly announces the successful acquisition of In3Act China, a renowned Strategy Consulting company based in Beijing. The acquisition was made possible through a strategic investment by The European House Ambrosetti, further solidifying Barbatelli & Partners’ position as a key player in the consulting sector in China.

The merger that combines the Chinese activities of Barbatelli & Partners and In3Act China marks an important milestone, bringing together two exceptional organizations with a shared vision for growth, innovation, and excellence in consulting sector. By joining forces, the combined entity will leverage the strengths and expertise of both companies to deliver even greater value and comprehensive solutions to clients in China.

This significant development not only strengthens Barbatelli & Partners’s market presence but also pays homage to the late co-founder of In3Act China, Guido Giacconi. Guido Giacconi’s legacy as a visionary and trailblazer in the China business consultancy will continue to inspire and guide the team as it embraces new opportunities and challenges in the evolving business landscape.

With this acquisition, Barbatelli & Partners aims to enhance its capabilities in key areas such as entry strategy, growth strategy, financial, legal, HR, investment and M&A operations. The integration of In3Act’s China talented team and extensive industry knowledge will complement Barbatelli & Partners’s existing resources, enabling the combined entity to deliver innovative solutions, drive operational excellence, and exceed client expectations.

The teams of both companies are committed to ensuring a seamless transition and integration process, ensuring minimal disruption to ongoing projects and client relationships. Clients of In3Act with existing or perspective interest towards China can expect continued support and the same high level of service they have come to expect, now backed by the expanded resources and global reach of Barbatelli & Partners.

Following this recent acquisition of In3act China operations, officially our organization has now expanded to include three entities:

- Barbatelli & Partners (Shanghai): It serves as the central hub for our organization, providing a wide range of management consulting services and facilitating seamless collaboration among our others entities. For more information, you can find at http://www.barbatelli.net/.

- BPCOM (Shanghai): BPCOM was founded from the extensive experience at Barbatelli & Partners. BPCOM is a digital company designed to create and manage digital marketing & PR services for foreign companies in China. You can visit our BP COM page at http://www.barbatelli.net/bp-com/.

- IN3ACT (Beijing): IN3ACT will be dedicated to offering a wide range of strategy consulting services while assisting the team for existing management consulting projects and the clients in Beijing. We invite you to explore our IN3ACT China website at https://www.in3act.com/en/.

We are excited about this new chapter and look forward to continuing to serve you with excellence and professionalism across all our entities!

Best regards,

Barbatelli & Partners

China’s Measures for Foreign Investment

China's Measures for Security Review of Foreign Investment

China's Measures for Security Review of Foreign Investment

Co-released by China’s National Development and Reform Commission (NDRC) and Ministry of Commerce (MOFCOM), the new Measure for Security Review of Foreign Investment aims at maintaining national security while promoting foreign investment. Released on December 19, 2020, enter into force on January 18, 2021.

The Measure applies to (1) foreign investors, alone or jointly with other investors, who invest in new projects or establish enterprises in China; (2) foreign investors who obtain equity or assets of domestic enterprises through M&A; (3) foreign investors who invest in China by any other means.

Investments subject to the Measure

- Foreign investment in the military industry, including military facilities, investment in the surrounding areas of military industry facilities and other national and security related areas

- Foreign investment in key areas related to national security, which includes agricultural products, energy and resources, equipment manufacturing, infrastructure, transportation services, cultural products and services, IT and internet products and services and financial services where such investment obtain the actual control of the invested enterprises.

In reference to ‘the actual control of the invested enterprises’, the term includes the following situations:

(1) foreign investors hold more than 50% of the shares

(2) foreign investors hold less than 50% of shares but their vote can significantly impact decisions of the board of directors or during shareholders’ meeting

(3) other situations in which foreign investors have significant influence in operational decisions, personnel and finances aspect of the enterprise.

The review will be led by NDRC and MOFCOM and the office will be located within NDRC.

Material to submit

Any investment that is within the scope listed above must be submitted to the review office by investors and concerned parties within China. The material to submit for the review are:

(1) Declaration form

(2) Investment plan

(3) Explanation on whether foreign investment affects national security

(4) Other materials required by the review office

The declaration shall specify the name, domicile, business scope and investment of the foreign investor. Applicants can modify or cancel the investment plan while undergoing the security review.

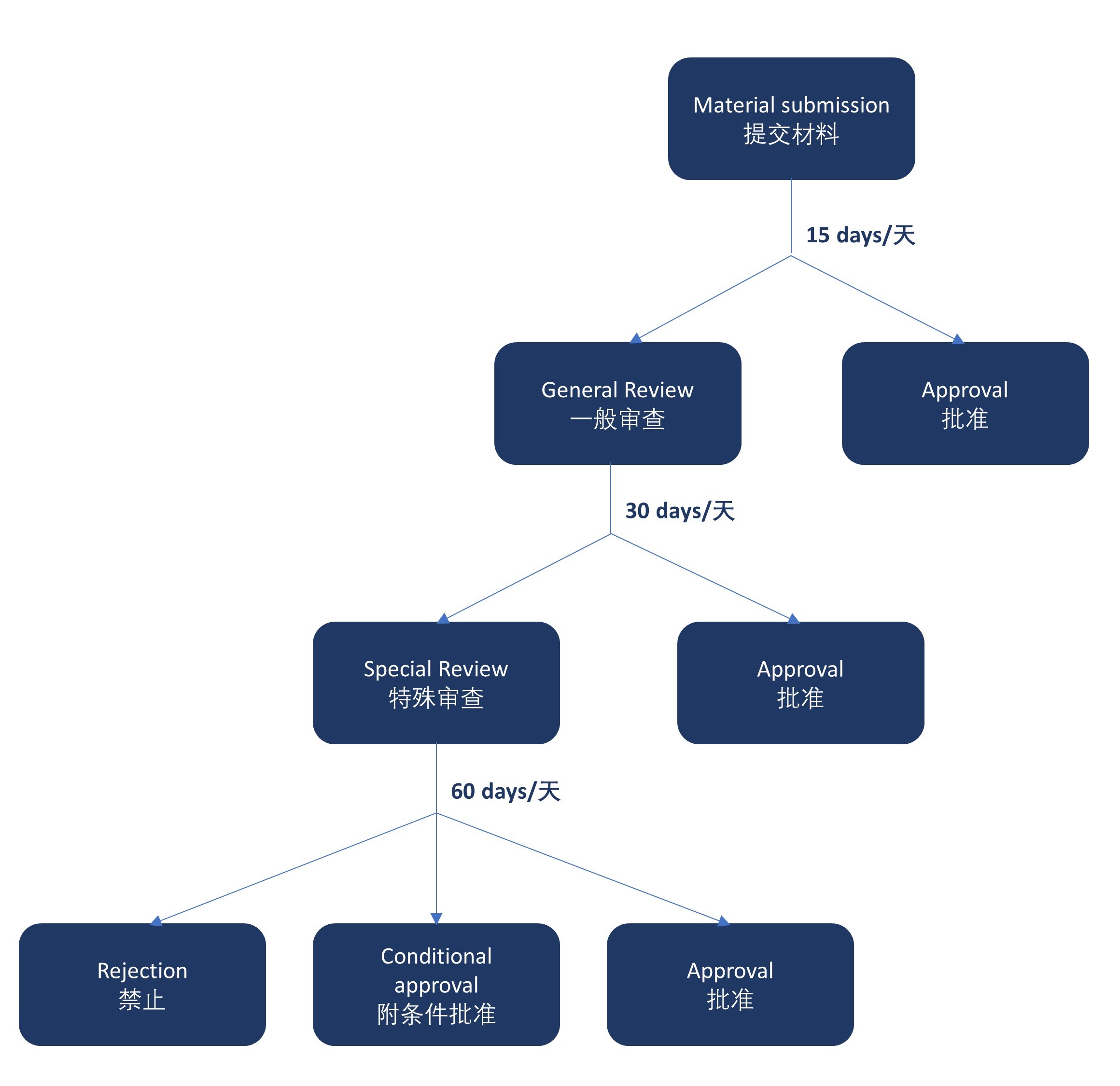

Review process based on a three-tiered system

Tier 1: Security Review Submission (15 working days). Once applicants submit the relevant material, the review office has 15 working days to decide whether the application needs to undergo a general security review. If not, the applicant may start to implement the investment.

Tier 2: General Security Review (up to 30 working days). The review office will have 30 days to inform applicants whether the project impacts national security and must undergo a special review. If the review office decides that it does not impact national security, investors may move forward with the project.

Tier 3: Special Review (60 working days). The review office will need 60 working days or more under special circumstances to conduct the special review. The review office can reject the project for national security reasons or provide either a full or conditional approval. Conditional approval requires that involved parties accept additional conditions that would “mitigate (the projects) potential impact on national security”.

China Digital Economy

China Digital Economy

China Digital Economy

In the dynamic evolution of the current economic and social context, businesses find themselves in a constant state of adaptation and innovation. Since the beginning of this year, the digital world saw a positive increase in order to overcome restrictions imposed by preventive pandemic measurements. Indeed, a large number of new business formats and models were implemented for instance online education, remote work, and contactless delivery. Implementation and innovation towards digitalization is a process that companies are still processing, which shows the potential and resilience of a digital economy.

Several businesses, that were originally focused on the offline, are accelerating the digitalization process, integreting online with offline activities. According to the "Hundreds of Digital Economy Application Scenarios" report, China’s new online service models are booming. Emerging technologies such as big data and artificial intelligence are being employed in every field, from production to logistics, from education to medical areas. The pandemic accelerated the process and the spread of these emerging technologies.

In Numbers

Taking a closer look to China, in 2019, the added value of China’s digital economy reached 35.8 trillion-yuan, which accounts for 36.2% of GDP. Its contribution to GDP growth was 67.7%. Additionally, in the first three quarters of 2020, the added value of high-tech manufacturing increased by 5.9% year-on-year. Since March, the average monthly growth rate has reached 9%. Software and information technology service industry achieved a year-on-year revenue growth of 11%. Particularly notable is the revenue from big data services and cloud services, which increased by 16% and 7% respectively.

The digital economy is moving upstream, driving high-level integration data, digital transformation, innovation, and leading high-quality development, demonstrating strong development resilience and potential. Aware of the huge potential and opportunities of the digital world, many Chinese provinces as Guangdong, Zhejiang, Hebei, Beijing are actively promoting and taking steps towards the construction and implementation of a sustainable and suitable digital economy.

In consideration of the digitalization path that businesses are taking on each aspect of its operation, a comprehensive digital marketing strategy and communication is essential. Indeed, in order to remain competitive, create visibility and awareness, businesses should focus on how to communicate and market on the digital level too. BPcom offers comprehensive digital marketing solution for your business operating in China.

China economy sees an increase in FDI

China economy sees an increase in FDI

China economy sees an increase in FDI

As a result of the effective pandemic's containment and the economic measurements supporting businesses in China, foreign direct investment (FDI) is going to increase on a yearly basis. According to the Ministry of Commerce, China’s actual use of foreign capital rose by 18.3% on a yearly basis to 81.87 billion yuan ($11.83 billion) in October.

FDI in China grew by 6.4% year-on-year to 800.68 billion yuan ($115.09 billion) between January and October. In particular, the services sector attracted 625.79 billion yuan of FDI in the first 10 months of 2020, up 16.2% on a yearly basis and accounting for 78.2% of the country's total use of foreign capital. FDI in the high-tech services sector grew by 27.8%.

The increase in FDI can be seen also as a sign of the positive sentiment among European businesses operating in the country. Indeed, the position paper of the European Chamber of Commerce show that 88% of European businesses are not considering shifting investment to other markets. A 62% still consider China within their company’s top three destinations for investments. During the assessment of the position paper, saw the contribution of 600 European businesses operating in Shanghai.

Foreign Investment Law, shortened negative lists for foreign investment and other supporting regulations, the signing of the Regional Comprehensive Economic Partnership, are boosting FDI flows to China and further reinforce the nation’s industrial and supply chains. Expectation from representatives of international organizations, foreign business councils in China and executives of multinational companies are towards more market and cooperation opportunities, as they call China's commitment to all-around opening-up in its new development blueprint.

China has basically brought the pandemic under control and got its economy back on track, seeing a steady recover. According to data from the country's National Bureau of Statistics, in October, China's value-added industrial output went up 6.9% year-on-year. Whereas retail sales of consumer goods, the main gauge of China's consumption, climbed 4.3% year-on-year.

Want to know more about China? Contact us!

China e-commerce market, where to start?

China e-commerce market, where to start?

The two largest e-commerce platforms Alibaba and JD.com during Double 11, the Global Shopping Festival, saw an increase in sales of 26% YoY and 32% YoY respectively. Alibaba Tmall reached 498.2 billion yuan (US$75.27 billion) and JD.com reached 271.5 billion yuan (US$41.02 bn) in GMV. These positive results show the potential and vastity of China e-commerce market despite the effect of the pandemic. Moreover, the restrictions and the habit changes shaped due to Covid-19 show the great opportunities businesses can create by going online and tackling China e-commerce market.

How is the industry outlook in China? Which e-commerce platform is best for your business? How to assess your products?

E-Commerce, where?

China E-Commerce market presents a variety of platforms, where brands and businesses promote and sell their products. The biggest well-known ones are Taobao, Tmall, JD.com and Pinduoduo. Other smaller platforms pervade the ecosystem, to cite few WeChat Mini-Shop, e-shop on Douyin (Chinese Tiktok) and Little Red Book, and XPanda. Each of these platforms presents unique features.

Where should you open your store? A market analysis is required to assess the industry outlook, the brand positioning, products feature and budget for the project. This will help you to consider and evaluate better your next step.

How to open?

Once you have decided the e-commerce platform to start with, you need to prepare in advance some documents.

- Company information: a registered entity in China (Wholly Foreign Owned enterprise or Sino-foreign Joint venture) or abroad, bank information

- Product trademark: register a trademark in China to protect your product

- Product Information: it is essential to have product description and photos for online sales.

How to operate?

Step 1: Launch of products with attractive titles, text descriptions, pricing, new product promotion, inventory maintenance and other activities

Step 2: Design & Optimize Stores

Design your online store, home page, product pages, promotion events

Step 3: Operational activities

Product selection, price setting, types of promotion, registration to shopping festival activities, data analysis

Step 4: Marketing activities to attract customers and achieve sales

Daily advertising operation, internal and external activities such as in-store or on e-commerce platform homepage’s product promotion.

BPcom and Barbatelli & Partners provide comprehensive services for brands aiming to enter China e-commerce market. What are our services?

- E-commerce project audit to find the best solution for your specific project and budget

- Registration and shop design/website

- Shop management and customer acquisition, by uploading, updating and managing contents in line with your requests

- Promotion and customer loyalty management, by creating and managing campaigns following the various events of China E-commerce calendar.

- Multi-Channel marketing strategy to create and increase brand awareness with PR, Kol and Seo.

Q&A Human Resources Policies for the Epidemic Period

Q&A: Human Resources Policies for the Epidemic Period

The PRC Government has started a series of national and local policies, aimed to support Small Medium Enterprises during this difficult time.

Barbatelli & Partners has prepared a Q&A document about HR policies and employment management during the Epidemic Period.

The document includes:

1) Enrolment of Employee

2) Labor Contract Management

3) Salary

4) Medical period and work injury

5) Holiday Management

6) Working hours and Overtime working

7) Safety Mangaement

Click on the link below for the entire document -

Q&A Human Resources Policies for the Epidemic Period

“Italy has to stay united and beat the crisis!” Cristiana Barbatelli on VareseNews.

‘Italy has to stay united and beat the crisis’

Recently, the coronavirus outbreak, originated in Wuhan, has reached the little cities of Northern Italy, scaring many towns into lock-down.

Varesenews.it, an online newspaper from Varese, Lombardy, contacted our CEO, Cristiana Barbatelli, to ask her about her thoughts on the situation. They contacted our CEO due to her close relation to Varese, as her family is living there now, while she returned to China on the 2nd of February.

Key points from the interview:

Why did you decide to return to Shanghai?

I decided to be there for my colleagues and fight this crisis with them.

How was the re-entry?

The situation was very hard and heavy (…) To return to work on the 12th of February, we had to prove that we had completed the 14 day quarantine.

Before that date, what could you do?

The two weeks before that date were very sad. We stayed at home as much as possible (…) I only left the house to buy food. (…) The ‘Salotto con Vista’ group chat I created, with other professionals, kept me alive: we talked, we laughed, we exchanged information and updated eachother.

How was Shanghai?

The city was empty. At 18, everything was closed.

How did the Chinese react?

A magnificent discipline, seriousness and coherency (…) national unitement.

What type of controls were happening?

Temperatures were taken at the entrances of home and work. They took your temperature outside the supermarket and you could not approach the cashier, if you were not wearing a mask.

How is it going now?

Since last week, things have become much better, in Shanghai at least. Some restaurants and shops have reopened. We work in the office with masks and our temperature gets taken twice a day.

How do you see the future of China after a crisis like this?

Living through SARS, 17 years ago, I have no doubts. China will exceed this crisis and beat the virus, it will take months, but they will do it. And we will do it too.

And Italy?

To who asks about the economic impact of this crisis, I respond that (…) we must find a way to have new solutions for work and new business models that work in the future even in these type of conditions.

What do you think of the relationship of our countries?

The economy will restart after the epidemic and with this fast push, we will work faster and win over our fears, the hesitations of our clients and our own hesitations.

What advice would you give Italy?

Italy (…) should use the same measures implemented by the Chinese population, believe in the results and fight the virus. The discipline of a population and the common motivation will create hope and positivity.

“ I am sure that we will do it, and also for us, this hell will finish”

Check out the entire interview here:

https://www.varesenews.it/2020/02/litalia-deve-stare-unita-battera-la-crisi/904269/

China Response to Novel Coronavirus: Live Updates, Municipal Policies and Measures

China Response to Novel Coronavirus Outbreak: Live Updates, Municipal Policies and Measures

While the Novel coronavirus continues to keep China stalled, the PRC Government has started a series of national and local policies, aimed to support Small Medium Enterprises during this difficult time.

Barbatelli & Partners has prepared a thorough analysis of these measures, as well as other info in this Live update.

Given the unpredictability of the situation, it is important to note that some info can be updated during the completion of the doc. We will do our best to keep updated the pdf quickly in order to provide the best information.

The document includes:

1) The policies in support of SME in the following cities:

Shanghai

Suzhou

Nanjing

Ningbo

Beijing

Chongqing

Guangdong

Hangzhou

2) Q&A section on practical situations about delayed return to work in Shanghai

3) Global Health links for monitoring Coronavirus live status

4) List of Italian Embassies and Consulates in China

Click on the link below for the entire document -

On 10th December B&P was given “Creatori di Valore” award.

Award by Fondazione Italia Cina, to a fantastic team, Barbatelli and partners!

Creatori di Valore!

"We did a good job guys, let’s go for our next goal. I think we’ll do better and better if we just stay focused and dedicated and if we never forget to love what we do.

This has been my life goal all along!"

To give more value to Italian Companies in China means that they will help create more value for China!

We do things seriously!

B&P Staff.

Contact us for more info at: info@barbatelli.net

Cristiana Barbatelli on Sky TG 24 during Salone del Mobile Milano Shanghai

On 28th November, an interview with Cristiana Barbatelli, CEO of Barbatelli and Partners on Sky TG 24 during Salone del Mobile Milano Shanghai!

B&P is honored to have attended the inspiring showrooms at the exhibition! The event was a memorable Italian lifestyle experience, the visitors were surrounded by wonderful interior designs made by Italian artists.

Contact us for more info at: info@barbatelli.net

July 2019 – Barbatelli & Partners and its team organized Salotto 360’s second event.

July 2019 - Barbatelli & Partners and its team organized Salotto 360’s second event.

In July, Barbatelli & Partners and its team organized Salotto 360’s second event. Salotto 360 aims to keep people connected and stimulated with interesting topics. The latest event was based on the subject of Human Archetypes. We analysed psychogenealogical studies with psycologist Dr. Bibiana Rueda Bueno, who explained to us the basics of archetypal structures and how they present themselves in Family and at work.

Barbatelli & Partners thank all the people who participated and contributed to creating such a successful event!

We sincerely thank our event sponsors: Gianluca, Evian Water, Simone Semprini of WM Fine Wines, and Funkadeli for providing quality food.

23rd July 2019 – “CICC Business Survey 2019 second edition”.

23rd July 2019 - "CICC Business Survey 2019 second edition”

The Italian chamber of commerce in China, CICC, in association with Assolombarda, organized a meeting discussing the results of “CICC Business Survey 2019 second edition” at the headquarters of Assolombarda in Milan, It was created to analyze the composition of the Italian business community in China and probe the perception of Italian companies’ outlook in the country.

The speakers at the event were: Davide Cucino, President of the Italian Chamber of Commerce in China; Guido D. Giacconi, Vice President of the Italian Chamber of Commerce in China and President In3act; Filippo Fasulo CeSIF Director at the Italy China Foundation.

The results of the research showed the current trend of Italian companies in China, talking about important points, such as: the healthy industrial community, EBIT and EBITDA implemented for the evaluation of the companies, FDI current situation in China, import-export practices, the lack of research and development in Italian companies, the IPR, the new environmental protection law, the labor cost and the future prospective that seems to be positive for the Italian community in China.

Talking about sectorial opportunities, Fabrizio Grillo of Bracco, discussed the current situation and strategies implemented by the mulmultinational Bracco in China.

During the meeting, there was a chance to network and debate. The supported debate arguments mainly cantered around the 2025 Made in China for the “China manufacturing” and the BRI, Belt Road Initiative.

B&P attended the events, for more information contact us at: info@barbatelli.net

Milan, 5th July 2019 – Italy’s stock exchange organized a seminar focused on the Belt & Road Initiative.

Milan, 5th July 2019 - “Borsa Italiana”, Italy's stock exchange, organized a seminar focused on the Belt & Road Initiative - ITALY AND THE NEW SILK ROAD.

The seminar program was divided into various topics addressed by various speakers of relief in Italy and China. The seminar introduced the initiative from a general point of view, addressing current developments in China and diving deeper into specific aspects of the initiave.

An important point that was discussed is the current and future role that Europe will play and relatedly explaining the opportunity and role Italy will be partaking in this global Initiative.

June 30th 2019 – Updated Negative Lists regarding foreign investment in China.

June 30th 2019 - Updated Negative Lists regarding foreign investment in China.

On June 30th the National Development and Reform Commission and the Ministry of Commerce published two updated negative lists regarding foreign investment in China.

The negative lists show the sectors in which foreign investment is restrained. One list is applicable to free trade zones and the other one is applicable to the rest of the country. The reduction of the “negative” list items shows that China is promoting a greater market for foreigner investors and at the same time also that less and less industries are restricted.

The list applicable to the FTZ has restricted business for 8 industries thus reducing the total industry count from 45 to 37.

Limitations for foreign investments have been removed in the following sectors:

- Fishing in geographic aquatic areas under China’s jurisdiction and inland waters;

- Exploration and mining of molybdenum, tin, antimony and fluorite;

- Publication printing;

- Xuan paper and Chinese ink ingot Production;

- Construction and operation of pipeline networks for gas and heat in cities with the population over 500,000 persons;

- Domestic shipping agency;

- Development of wildlife resources originating in China under State Protection;

- Construction and operation of cinemas.

The list applicable in the rest of the country has been reduced from 48 to 40 industries.

The businesses sectors removed from the negative list are:

- Exploration and exploitation of oil and natural gas;

- Exploration and mining of molybdenum, tin, antimony and fluorite;

- Production of Xuan paper and Chinese ink ingot;

- Construction and operation of pipeline networks for gas and heat in cities with the population over 500,000 persons;

- Domestic shipping agencies;

- Development of wildlife resources originating in China under State protection;

- Construction and operation of cinemas;

- Performance brokers.

New updated negative lists:

Special Administrative Measures for Access of Foreign Investments (Negative List) (2019 Edition)

https://docs.wixstatic.com/ugd/02e245_6700578467574b92953cadc36e625bc2.pdf

Special Administrative Measures (Negative List) for Foreign Investment Access in Pilot Free Trade Zones (2019 Edition)

https://docs.wixstatic.com/ugd/02e245_fd0b85b2ddd7451881d7eb999222021f.pdf